Market value and customs value are two terms that are often confused but have different meanings and applications. While the market value describes the price a good achieves on the open market, the customs value serves as the basis for calculating duties and import VAT. Incorrect declarations can have costly consequences, especially for imports into Germany.

Overview:

- Market value: Price that buyers would pay under normal market conditions.

- Customs value: Actual price paid including shipping and insurance costs.

- Important: Since July 1, 2021, import VAT is charged from the first cent.

- Avoid mistakes: Incorrect declarations lead to back payments, fines, or confiscation.

An example: A good with a market value of €220 and a customs value of €180 incurs different duties. The customs value is crucial for customs declaration.

The distinction between both values is essential to avoid legal issues and unnecessary costs.

What is the Market Value (Market Value)

Definition of Market Value

The market value describes the price that a product – such as hunting equipment or firearms – would achieve under normal market conditions. It is the amount that an interested buyer would pay to a willing seller, with both being well-informed and acting without external pressure.

This value reflects the current price that the market actually offers. Unlike the purchase price or insurance value, the market value refers exclusively to the realistic trading value in the open market.

How to Determine the Market Value

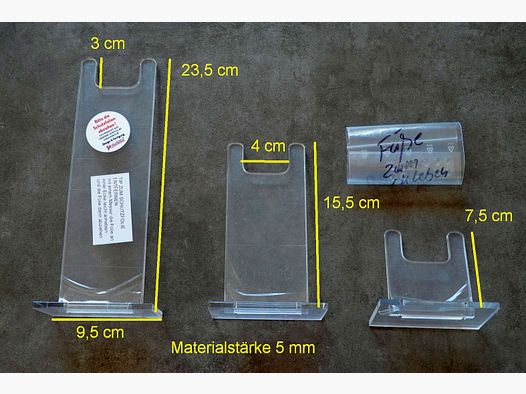

To determine the market value of an item, a thorough analysis of current offers is necessary. A good starting point is research on specialized platforms like Gunfinder, which summarize a variety of offers and completed sales for hunting equipment. Such platforms provide a transparent basis for better estimating the market value.

Several factors influence the market value of a product:

- Condition: Whether the item is new, used, or refurbished directly affects the price.

- Brand and model: Renowned manufacturers like Blaser, Zeiss, or Sig Sauer often achieve higher prices.

- Age and rarity: Older or rare items can be particularly sought after depending on demand.

- Current market demand: How desirable the item is among hunters or collectors also plays a role.

An example: You want to sell a Blaser R8 hunting rifle in good condition. The first step would be to check similar offers on Gunfinder. If comparable models are trading between €2,200 and €2,800, you can adjust the value of your rifle accordingly – taking into account its condition and any possible special features.

It is advisable to compare at least three comparable offers regarding condition, maintenance, and any upgrades. For particularly high-quality or rare items, it may also be worthwhile to consider a professional appraisal by experts.

Online marketplaces like Gunfinder make this analysis easier, as they list hundreds of new offers for hunting weapons, optics, and accessories daily. On German platforms, prices for used hunting rifles usually range between €300 and €3,000, depending on brand, model, and condition. A correctly determined market value is particularly important to avoid problems later during customs processes.

What is the Customs Value

Definition of Customs Value

The customs value refers to the value of a good that is declared upon crossing the border and serves as the basis for calculating duties and import VAT. While the market value is oriented towards free trade, the customs value is a fixed figure specifically used for tax purposes.

According to Article 70 of the Union Customs Code (UCC), the customs value is based in most cases on the so-called "transaction value." This is the actual price paid or payable when the goods are sold for export to the EU. This uniform regulation ensures that importers in all EU countries are treated according to the same standards.

An example: The customs value of an imported hunting rifle can differ significantly from the German market value.

Calculation of Customs Value

The calculation of customs value takes into account all costs incurred up to the EU border. This includes freight, insurance, and handling costs, as well as license or patent fees, if these are a condition for sale. The value of goods or services received free of charge by the buyer – such as special tools or molds – is also included.

An example: You buy a hunting rifle in the USA for €1,500. The shipping costs amount to €150, and the insurance is €30. The customs value is therefore €1,680 (€1,500 + €150 + €30). This amount serves as the basis for calculating the import VAT (19%) and possible duties.

For CIF deliveries (Cost, Insurance, Freight), shipping and insurance costs are already included in the purchase price. For FOB deliveries (Free on Board), these must be added separately.

If the transaction value cannot be determined – for example, in the case of gifts or samples – a predetermined order of alternative valuation methods applies: the value of identical goods, the value of similar goods, derived value, computed value, and finally the fallback method.

Required Documents for Customs Value

To declare the customs value correctly, certain documents are required. These include: the commercial invoice with delivery terms, shipping documents, proof of payment, insurance confirmations, a packing list, and the customs declaration (Form 0350).

For hunting equipment, additional documents may be necessary, such as firearms permits, CE markings for optical devices, or manufacturer certificates for ammunition. Gunfinder offers support to quickly and easily obtain all necessary documents – especially helpful for regular importers.

Common mistakes in documentation, such as omitting freight or insurance costs, using incorrect invoices, or missing proof of payment, can lead to back payments, fines, or criminal consequences. Careful preparation saves you trouble and unnecessary costs later.

| Goods Value | Import Duty |

|---|---|

| Up to €150 | €7.20 |

| €150 to €1,000 | €14.40 |

| Over €1,000 | €43.20 |

Since July 1, 2021, import VAT applies from the first cent – the previous exemption for shipments up to €22 has been abolished.

Main Differences Between Market Value and Customs Value

Market Value vs. Customs Value in Comparison

Market value and customs value fundamentally differ in their definition, purpose, and application. The market value describes the price that hunting equipment would achieve under normal market conditions. The customs value, on the other hand, is used exclusively for calculating import duties.

| Criterion | Market Value | Customs Value |

|---|---|---|

| Definition | Price under normal market conditions | Transaction value for customs purposes |

| Calculation Basis | Supply, demand, comparable sales | Invoice price + freight + insurance |

| Legal Basis | No specific regulation | EU Customs Code (UCC, Art. 70 et seq.) |

| Purpose | Sale, insurance, valuation | Customs clearance, tax calculation |

| Required Documents | Market analyses, comparable offers | Commercial invoice, customs declaration |

| Influencing Factors | Condition, rarity, market demand | Actual purchase price, transport costs |

The market value is based on current market conditions, while the customs value follows strict legal requirements and must be documented accurately.

Example: Suppose the market value of a hunting rifle is €1,500 on Gunfinder. However, if you buy it abroad for €1,200 and pay an additional €180 for shipping, the customs value amounts to €1,380.

This table illustrates the differences and shows why it is important to understand both values correctly.

Why These Differences Are Important

The differences between market value and customs value have practical consequences, especially in customs clearance and pricing. A clear distinction is crucial to avoid legal problems and exclude financial disadvantages. Many hunters and dealers confuse the two terms, which can lead to costly mistakes.

When declaring customs, it is essential to provide the actual transaction value. Customs authorities require complete and accurate information. Incorrect values can lead to back payments, fines, or even criminal consequences.

The market value, on the other hand, plays a central role in pricing, such as in sales or insurance cases. Platforms like Gunfinder help determine the current trading value of your equipment. Especially for rare or antique hunting weapons, the market value can differ significantly from the original purchase price.

The required documents also differ: For customs value, complete purchase receipts are necessary, while for market value, comparable offers or appraisals are sufficient. This knowledge saves time and prevents delays in import.

Another important point: The precise recording of the purchase price directly affects your import costs. Example: With a customs value of €1,380, €262.20 in import VAT (19%) is incurred. A correct calculation allows for better budget planning and protects against unexpected expenses.

sbb-itb-1cfd233

Impact on Hunters and Dealers

Common Problems and Risks

Errors in declaration can quickly become expensive. A typical example: Hunters often state the personal use value instead of correctly indicating the actual transaction value. Customs authorities calculate the customs value according to the CIF method (Cost, Insurance, Freight), which includes shipping and insurance costs – these are often overlooked.

Dealers also make mistakes by declaring used equipment at unrealistically low prices while overemphasizing depreciation. However, customs regulations require the actual price paid. If important documents such as invoices, receipts, or shipping documents are missing, customs inspections and delays may occur.

The financial consequences of such errors can be significant. In addition to regular import duties and VAT (19% in Germany), customs authorities impose penalties for violations that can range from 5% to 100% of the incorrectly declared amount. In cases of intentional fraud, criminal consequences are also possible. Additionally, shipments can be held indefinitely in customs, leading to storage fees and delivery delays. For dealers, repeated violations can have even more severe consequences, such as the revocation of import privileges or increased scrutiny of future shipments. If systematically incorrect values are declared, authorities may demand back payments for previous imports – including interest and penalties that can quickly amount to thousands.

Practical Examples and Scenarios

To make these risks more tangible, here are some examples:

- Example 1: A hunter buys a used hunting rifle for €1,200 from a private seller in Poland via Gunfinder and pays an additional €50 for shipping. The correct customs value is therefore €1,250. However, if the hunter mistakenly states the German market value of €1,500, unnecessary additional costs of about €297 arise.

- Example 2: A dealer imports hunting jackets at a wholesale price of €30 each, which he later wants to sell for €89. The customs value here is €30 per jacket. However, if the market value (€89) is mistakenly stated, the costs rise to around €106 per jacket – an increase in import costs of a whopping 194%.

- Example 3: A dealer buys 1,000 rounds of ammunition at a unit price of €0.50 (total €500), while the market value is €0.75 per round (total €750). An incorrect declaration would lead to additional costs of about €250 to €300.

Best Practices for Accurate Valuation

To avoid problems, complete and accurate documentation is essential. All purchase invoices, payment receipts, and delivery contracts should be kept for at least five years, as customs authorities can check these at any time. Especially for purchases via Gunfinder, it is advisable to save screenshots of the listing, purchase confirmation emails, and the transaction history.

A clear valuation policy helps to determine the customs value for each shipment correctly – based on actual transaction values. Before importing, it is also important to determine the appropriate customs tariff number (HTS classification) for the products, as duty rates can vary depending on the type of goods.

For dealers who import regularly, an AEO certification (Authorized Economic Operator) can be beneficial. This facilitates customs procedures and reduces the frequency of inspections. Additionally, complete documentation should be submitted from the outset for customs declarations, such as commercial invoices, packing lists, and certificates of origin.

A close exchange with suppliers is also crucial. Invoices should clearly state the actual price paid and all relevant costs (such as shipping and insurance). For particularly valuable shipments or new product categories, it is advisable to consult with German customs in advance to avoid costly delays or disputes.

Gunfinder provides transparent pricing information that helps determine the correct customs value and avoid import issues.

Important Points at a Glance

Main Differences in Focus

The market value shows the price that a good can achieve on the open market, while the customs value is specifically used for calculating import duties and VAT. The customs value is the paid price plus all costs incurred up to the EU border.

There are six different methods for determining the customs value, with the transaction value method always taking precedence. The financial implications can be illustrated with an example: A product with a market value of €220 can increase total costs to about €267.56 due to customs and import VAT.

Practical Tips for Dealing with Customs Value and Market Value

To avoid costly mistakes and comply with all customs requirements, the following measures are crucial:

- Carefully keep receipts: Customs authorities can request proof at any time. For purchases via Gunfinder, it is advisable to save screenshots of listings as well as purchase confirmation emails.

- Use reliable platforms: Platforms like Gunfinder help realistically assess the current market value of hunting equipment. The market prices and transaction histories available there can be extremely helpful during customs inspections.

- Check import regulations: Before each import, the specific import conditions and the correct customs tariff number (HTS classification) for the respective product should be checked, as duty rates can vary depending on the type of goods.

Incorrect declarations regarding customs value can have serious consequences, such as back payments, fines, or even the confiscation of goods. It is better to ask customs one more time or consult an expert than to face high costs later. A precise valuation from the outset saves not only money but also time and unnecessary hassle.

Everything Important About Import Duties - Simply Explained!

FAQs

How do I find the correct customs value for my hunting equipment when importing?

The customs value is the basis that customs uses to calculate import duties. It is crucial to consider all relevant aspects correctly. Here are the key points you should keep in mind:

- Invoice value: The amount you actually paid for the goods serves as the starting point.

- Additional costs: This includes transport, insurance, and packaging costs up to the first destination within the EU.

- Discounts and rebates: Any price reductions or benefits can influence the customs value and must be stated correctly.

A complete and accurate declaration is essential to avoid unnecessary delays or additional costs. If you are unsure, it is worth contacting customs directly or consulting an expert in customs matters.

What happens if the market value or customs value is incorrectly stated when importing into Germany?

An incorrect declaration of the market value or customs value when importing into Germany can have serious consequences. Possible outcomes include fines, penalties, or even the confiscation of goods by customs. Additionally, extra taxes and fees may be imposed if irregularities are discovered.

To avoid such problems, it is crucial that all information is provided accurately and completely. The customs value forms the basis for calculating import duties, while the market value reflects the actual value of the goods. It is advisable to prepare all relevant documents carefully and consult an expert in case of uncertainties. This way, you can ensure that your import is processed smoothly.

What documents do you need to correctly state the customs value, and how can Gunfinder help you with this?

To correctly state the customs value, you typically need documents such as purchase receipts, invoices, or contracts that clearly prove the value of the goods. Additionally, transport papers and insurance certificates may be required to carry out the calculation completely and accurately.

Gunfinder makes this process easier by providing a platform where you can securely and transparently buy or sell hunting equipment. This gives you a clear overview of the market value of your items – an important aid in customs clearance. Keep all relevant documents well to avoid possible complications later.