For hunters traveling abroad with their equipment, customs regulations are often a challenge. Depending on the country, the requirements can vary significantly, and mistakes can lead to delays, fines, or even confiscations. This article provides an overview of the regulations in Germany, Austria, the USA, Canada, and South Africa.

Important Points:

- Germany: Strict regulations, including customs declaration (Form 0350), import VAT (19%), and permits for firearms and ammunition.

- Austria: Simplified procedures for EU citizens with a firearms pass; non-EU citizens require additional permits.

- USA: CBP Form 4457 is recommended to facilitate the re-importation of firearms. Strict security regulations.

- Canada: Form RCMP 5589 for firearms required, fees starting at 25 CAD. Strict controls.

- South Africa: SAPS Form 520 required for temporary firearm import, many restrictions (e.g., max. 200 rounds of ammunition).

Conclusion:

Careful preparation and knowledge of the specific requirements in the destination country are crucial to avoid problems. Missing or incorrect documents can lead to long delays. It is worthwhile to check customs regulations in advance and fill out all forms correctly.

Legal Import of Firearms and Accessories from the USA

1. Germany

Hunters in Germany must adhere to strict firearm laws and customs regulations when returning from abroad. These regulations are specifically tailored for German hunters and form an important basis for later comparisons with other countries.

Important Forms

If you bring "personal property" from non-EU countries, the German customs declaration form 0350 (customs declaration) is required. This form declares the type, quantity, value, and origin of the imported goods. For firearms and ammunition from non-EU countries, you need prior approval and must also declare them to customs.

For exports, the necessary documentation depends on the goods, their commercial value, and the destination country. Typically, the International Air Waybill and the Commercial Invoice are required. Additionally, an EORI number is mandatory for imports and exports to or from non-EU countries.

Fees

The import duties consist of customs and import VAT, with the latter being 19% (or 7% for certain goods). For private shipments valued under 700 €, a flat rate of 17.5% applies, while preferential goods incur a rate of 15%.

An example: A product valued at 220 € can incur customs and import VAT, resulting in total costs of approximately 267.56 €.

Processing Time

When all documents are complete, customs clearance typically takes 1 to 3 days. The process can be expedited through electronic data interchange (EDI) and cooperation with authorized economic operators (AEO).

Important Notes

The German customs administration monitors the flow of goods at the EU external borders as well as domestically through mobile controls. Be sure to inform yourself in advance about current regulations, especially if you wish to import firearms and ammunition.

For tax relief with Form 0350, you must have lived outside the EU for at least 12 months, establish a new residence in Germany, and have owned the goods for at least six months.

The illegal importation of firearms and ammunition is strictly punished in Germany. Penalties can include imprisonment for up to five years, and in particularly severe cases, up to ten years.

Ensure that you classify your goods correctly according to HS codes and stay informed about changes in customs regulations, duty rates, and trade agreements. In complex cases, the assistance of a customs broker or logistics expert familiar with German customs procedures can be helpful.

In the next section, we will take a look at the customs regulations in Austria.

2. Austria

Austria has specific regulations for the import and export of hunting equipment, which vary depending on the country of origin and the type of equipment.

Required Forms

For firearms and ammunition from EU countries, simplified regulations apply. Hunters may carry up to three firearms (excluding handguns) and ammunition without a permit, provided they possess a European Firearms Pass and can present a documented reason for travel. However, hunters residing in Finland whose firearms are registered in the European Firearms Pass require a permit from the Austrian authorities.

Non-EU citizens who do not possess an Austrian or European firearms license must apply for a permit to import firearms into Austria. This requires a valid passport, a firearms permit from their home country, and a certificate of good conduct.

For shipments to non-EU countries, a customs declaration is necessary. This includes the CN 23 customs declaration, the CP 71 package card, and a commercial or pro forma invoice. If no electronic pre-data entry is made, the CN23 form can be used in paper form.

Fees and processing times additionally influence the handling.

Fees

A fee of 42.00 Euros is charged for the approval of firearms. If the CN23 form is used in paper form and the data is only recorded electronically at the time of submission, a 2.90 Euro service fee applies.

Upon import, customs and import VAT are calculated based on the CIF method – that is, based on the value of the goods plus shipping costs. Additionally, customs clearance fees may arise for processing the documents.

Since July 1, 2021, the VAT exemption for shipments up to 22 Euros has been abolished. The import VAT of 20% is due from the first cent. Customs duties apply from a goods value of 150 Euros.

| Goods Value | Import Duty |

|---|---|

| Up to 150 Euros | 7.20 Euros |

| 150 to 1,000 Euros | 14.40 Euros |

| Over 1,000 Euros | 43.20 Euros |

Additionally, the Austrian Post charges a processing and storage fee of 34.56 Euros when contacting the recipient.

Processing Time

The processing time may be extended due to veterinary controls, especially for hunting trophies. Frequent delays occur due to incomplete documents, such as missing veterinary certificates.

When entering from EU countries, there are usually no customs checks; however, random checks may be conducted. For entries from non-EU countries, the regular customs procedures apply.

Special Notes

If you are traveling with hunting equipment by plane, you should inquire in advance with the airline about the transport conditions. Firearms and ammunition must be transported separately, and the firearm case must be locked.

For border crossings with animal products, registration with the border veterinarian is required at least one working day in advance. Ensure that all documents, including veterinary certificates for hunting trophies, are correct and complete.

A customs broker or an account with courier services like FedEx or DHL can expedite the customs process. Incorrect declarations regarding the value will be treated as tax evasion.

In the next section, we will address the more complex regulations in the United States.

3. United States

Compared to the regulations in Germany and Austria, customs regulations in the USA are even more complex. The U.S. Customs and Border Protection (CBP) strongly recommends familiarizing yourself with the applicable regulations before importing or exporting goods.

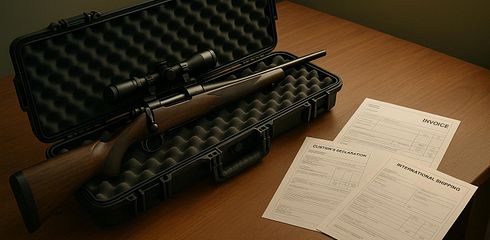

Required Forms

For imports and exports to and from the USA, various documents are required. These include the Entry Manifest or the application for immediate delivery (CBP Form 7533 or 3461), a commercial invoice, packing lists, as well as the Declaration Form 6059B and the Entry Summary (CBP Form 7501). These customs documents must be submitted within 15 days of arrival.

For exports with a goods value over 2,500 US dollars or when an export license is required, an Electronic Export Information (EEI) must be submitted. Exporters are also required to determine the appropriate Schedule B number for their goods.

A special form that particularly concerns hunters is the CBP Form 4457 “Certificate of Registration for Personal Effects Taken Abroad.” Greg Ray, founder of Outdoor Solutions, recommends that all customers taking their firearms abroad carry this form filled out.

"Although form 4457 is not required, it is a big help for hunters returning to the United States. Having it will save a lot of headaches - and dollars." - Nate Peeters, CBP's Office of Public Affairs

After submitting all documents, the fee regulations follow.

Fees

Different fees apply for customs clearance in the USA. For formal entries, the Merchandise Processing Fee (MPF) is 0.3464% of the goods value, with the fee ranging between 32.71 and 634.62 US dollars. For informal entries, the costs are lower, ranging between 2.62 and 11.78 US dollars. Additionally, for sea freight, a Harbor Maintenance Fee (HMF) of 0.125% of the goods value is charged.

Other possible fees:

- Customs broker fee: 100-150 US dollars

- X-ray inspection: approx. 300 US dollars

- Intensive examination: starting at 1,000 US dollars

- Continuous bond: approx. 500 US dollars

The amount of customs duties depends on the classification according to the Harmonized Tariff Schedule (HTS) as well as the country of origin of the goods.

Processing Time

Processing times can vary significantly and depend on the completeness of the submitted documents as well as possible inspections. For ATF approvals related to firearms, non-immigrants should plan for a lead time of 2-3 months.

Special Notes

In general, non-U.S. citizens are prohibited from possessing firearms or ammunition. However, there are exceptions, such as for hunting or shooting sports purposes. Anyone wishing to temporarily import a firearm for hunting purposes as a non-immigrant needs an ATF permit (ATF Form 6NIA).

"It is the traveler's responsibility to be aware of these regulations in order to ensure their trip goes smoothly." - CBP Press Release

Strict security regulations apply when transporting firearms. They must be transported unloaded and securely packaged – in the airplane as checked baggage in a hard-shell case and in the vehicle out of reach. Ammunition must be stored separately. The TSA considers a firearm loaded if the firearm and ammunition are easily accessible.

U.S. citizens traveling with a firearm out of and back into the USA should register it with the CBP before departure. However, registering it as checked baggage does not permit importation into other countries. Hunters should also obtain a hunting license for the respective state and familiarize themselves with local gun laws.

Next, we will take a look at the regulations in Canada – a particularly interesting destination for American hunters.

4. Canada

Canada has specific customs regulations for hunting equipment, which are strictly monitored by the Canada Border Services Agency (CBSA). The import regulations for firearms are particularly in focus. Here you will find an overview of the necessary forms, fees, and processing times.

Required Forms

For hunters wishing to import firearms into Canada, the RCMP 5589 – Non-Resident Firearm Declaration form is crucial. If you do not possess a Canadian firearms license and are bringing non-restricted or restricted firearms, you must fill out this form. It serves as a temporary license and is valid for up to 60 days upon confirmation by a border officer. The form can be obtained at the border or downloaded in advance.

If it involves commercial imports, a Canada Customs Invoice (CCI) or a commercial invoice is also required. This can be created by the supplier, importer, or a customs broker.

Fees

Canada calculates customs duties and taxes based on the CIF method (Cost, Insurance, Freight). This means that both the goods value and shipping costs are included in the calculation.

-

Basic Fees:

- Form RCMP 5589: 25.00 CAD

- GST (Goods and Services Tax): 5% on most goods

- Processing fee by Canada Post: 9.95 CAD

Customs rates vary depending on the type of goods and their country of origin. For example, customs rates for clothing are 16-18%. An example for illustration: For an import of goods valued at 100 US dollars (approx. 115 CAD) with a customs rate of 4%, 4.60 CAD in customs duties will apply. The GST of 5% will then be calculated on the goods value including customs, resulting in total duties of approximately 10.58 CAD.

Processing Time

The duration of customs clearance depends on the shipping method:

- Express shipping: 1-2 business days

- Air freight: 2-4 business days

- Sea freight: 5-7, maximum 10 business days

- Postal shipping: 3-10 business days

The processing time is influenced by the accuracy of the documents, the type of goods imported, the amount of customs duties and taxes, and the current workload of customs.

Special Notes

To avoid delays, it is advisable to engage a licensed customs broker. They can submit the customs documents before the shipment arrives and ensure that the correct HS codes (Harmonized System) are used. Incomplete or incorrect documents often lead to delays. Additionally, random or risk-based inspections can extend the clearance time. Note that certain goods – such as food, medicines, or chemicals – may require additional licenses or certificates.

In the next section, we will discuss the regulations in South Africa.

sbb-itb-1cfd233

5. South Africa

South Africa places great importance on controlling hunting equipment, especially regarding the importation of firearms and ammunition. Monitoring is carried out by the South African Police Service (SAPS), and several specific forms are required. Here you will learn what documents and steps are necessary.

Required Forms

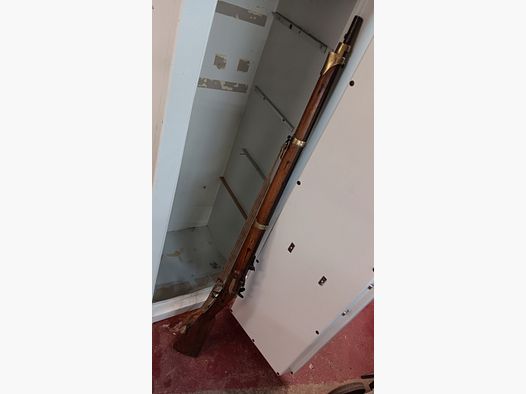

For the import of hunting rifles, the SAPS 520 form must be filled out. This must be written in black ink and can only be signed in the presence of a police officer [55,57,59].

U.S. citizens additionally require the Customs Declaration Form 4457 as proof of ownership of the firearm. This document must be valid during the travel year and must not expire during your safari [55,58,59,60].

Other necessary documents include:

- An invitation letter from your hunting organizer

- A copy of your passport

- A copy of your flight itinerary

Note that your passport must have at least two blank pages and be valid for at least six months beyond the end of your trip [58,59].

Fees

The calculation of import duties and taxes is based on the CIF method, which takes into account the goods value as well as the shipping costs. The following fees apply:

- Customs Duties: Depending on the type of goods

- Value Added Tax (VAT): 15% on imported goods

- Broker Fees: For customs clearance

The VAT is calculated using this formula:

[(Customs value + 10% of that) + (non-refundable customs)] × 15%.

A 10% surcharge does not apply to goods from Botswana, Lesotho, Namibia, or Eswatini.

Payments can be made in South African Rand, either in cash or by card.

Processing Time

The processing duration depends on the completeness of your documents and the workload of the customs authorities. To avoid delays, it is advisable to seek assistance from a licensed customs broker. Applications for temporary import permits can be submitted either to the Central Firearms Control Register in Pretoria or to the Designated Firearms Officer at the point of entry. The original permit must always be carried with you.

Special Notes

South Africa has strict rules for the importation of firearms and ammunition. A temporary import permit is required, which is issued after entry at the SA Police Firearm Office [65,66].

Important Restrictions:

- No automatic, semi-automatic, or military weapons [66,67]

- No weapons for self-defense [66,68]

- Maximum one firearm per caliber [66,68]

- At most 200 rounds of ammunition per caliber [65,66,68]

- Minimum age for import: 21 years [65,66,68]

The firearms may only be used for the approved purpose. Transferring them to other persons in South Africa without the written consent of the registrar is prohibited. Additionally, the firearms must accompany the owner when leaving the country.

If you are traveling with South African Airways (SAA), notify your weapon in advance during reservations, declare it at check-in, and plan for a processing fee.

In the next section, we will compare the requirements of other countries.

Comparison of Requirements

The regulations regarding customs for hunting equipment vary significantly between countries. While some states offer straightforward procedures, others require extensive documentation and incur additional costs – which can greatly affect travel planning and budgeting. Here we summarize the key differences and show how these requirements impact various countries.

Overview of Requirements

| Country | Required Forms | Fees | Special Considerations |

|---|---|---|---|

| Germany | Transfer license (for transit via Frankfurt) | 20 € | Required only for transit; temporary export within 24 months possible |

| Austria | Austrian forms – details vary | Variable | No specific information provided in sources |

| USA | CBP Form 4457 (recommended) | Free | Not mandatory, but helpful to avoid problems |

| Canada | Form 5589 (Non-Resident Firearm Declaration) | 25 CAD | Strict controls; 200-300 U.S. citizens face declaration issues annually |

| South Africa | SAPS 520 and certified copy of Form 4457 | Variable | Complex requirements; Rifle Permit available for about 300 USD |

Advantages and Disadvantages of the Systems

The USA offers a straightforward and free system: The CBP Form 4457 is easily accessible and ensures a smooth process. Canada, on the other hand, charges a fee of 25 CAD and enforces the regulations very strictly. According to the U.S. State Department, 200-300 U.S. citizens encounter difficulties each year because they do not properly declare their firearms.

Germany presents a pragmatic approach with a moderate fee of 20 € for the transfer license in transit via Frankfurt. Additionally, hunters can temporarily export their firearms as personal effects, provided they are re-imported within 24 months.

South Africa represents a more complex system: In addition to the SAPS 520 forms, a certified copy of Form 4457 is often required. A Rifle Permit for about 300 USD can facilitate the process but remains an additional hurdle.

Processing Times and Costs

Processing times depend heavily on the completeness of the documents. In the USA, intensive customs inspections can take between 5 and 7 days and incur costs of over 2,500 USD. Late submission of Importer Security Filings can also result in fines of up to 5,000 USD.

Practical Tips

To save time and costs, all forms should be filled out and copied multiple times well in advance of departure. Terry Blauwkamp, an experienced hunter, explains:

"There are a lot of hoops to jump through, but it is not all that bad as you just take them one step at a time. I've done it plenty of times, and now it is just second nature."

The choice of destination therefore depends not only on hunting opportunities but also on how much effort you are willing to invest in the respective customs procedures.

Conclusion

The customs regulations for hunting equipment can vary significantly from country to country. While the formalities in the USA and Germany are often relatively straightforward, countries like South Africa require significantly more extensive proof and documentation. Such differences make thorough preparation essential to avoid difficulties at the borders.

Some countries rely on restrictive regulations – from import restrictions to recommendations to rent hunting firearms locally rather than bringing them in.

Practical Tips for Hunters

As Steve Ehrlich points out, legal requirements often change, so it is important to prepare all necessary documents early. Firearms and ammunition should always be declared at every border, and copies of all relevant proofs should be readily available. Inform yourself about TSA regulations as well as the regulations in the destination country. Also, consider in advance whether you want to take your own firearms or prefer to rent them locally, and allow sufficient time for customs clearance.

Gunfinder as a Helpful Resource

Gunfinder not only offers a wide selection of hunting equipment but also current information on customs and firearms regulations. This way, you are well-informed and can efficiently plan your hunting trips.

The choice of destination should therefore not only depend on hunting opportunities but also on the requirements of customs formalities. With careful preparation and the right information sources, even more demanding regulations can be easily mastered.

FAQs

What documents do I need to import hunting equipment into South Africa, and how long does the process take?

Import of Hunting Equipment into South Africa

If you want to bring hunting equipment into South Africa, you need some important documents. These include:

- An import permit

- A copy of your flight ticket

- Your passport

- Proof of ownership for the firearms

It is crucial that all documents are complete and correctly filled out to avoid unnecessary delays.

The processing time for the application can vary, as it depends on the relevant authorities. It often takes several weeks for everything to be processed. Therefore, you should submit the application in good time – especially before the start of the hunting season or if you plan to travel on short notice.

What customs regulations apply to the import of hunting equipment into the USA and Canada?

Customs Regulations for Hunting Equipment in the USA and Canada

The customs regulations for hunting equipment are quite different in the USA and Canada.

In the USA, you must declare your hunting firearms and equipment to customs with a so-called Non-Resident Firearm Declaration. Note that certain items, such as knives with spring mechanisms, are prohibited for import.

In Canada, the import of hunting firearms is also subject to a declaration requirement. Additionally, there are specific restrictions, such as for crossbows or bows that can be operated with one hand. Strict regulations regarding age and transport also apply. Therefore, it is advisable to thoroughly inform yourself about the applicable regulations in advance to avoid difficulties upon entry.

What permits do I need to transport hunting firearms within the EU?

For the transport of hunting firearms within the EU, the European Firearms Pass (EFP) is a must. This pass contains all important information about you and your firearms and remains valid for five years. However, some countries may require additional national permits. Therefore, you should inform yourself early with the relevant authorities in your destination country to ensure that you meet all necessary regulations.

It is also important to check the import and export regulations of the respective country, as these can vary depending on the destination. Thorough preparation ensures that you avoid unpleasant surprises at the border.